Nikkei 225 August volatility analysis

August has summer and Obon holidays in Japan but there are many trading opportunities in the Nikkei 225 index and traders should be ready to take advantage of profitable trading opportunities.

2022 has seen a large reversal in world equity markets as higher inflation and interest rates have resulted in investors getting more worried about the future.

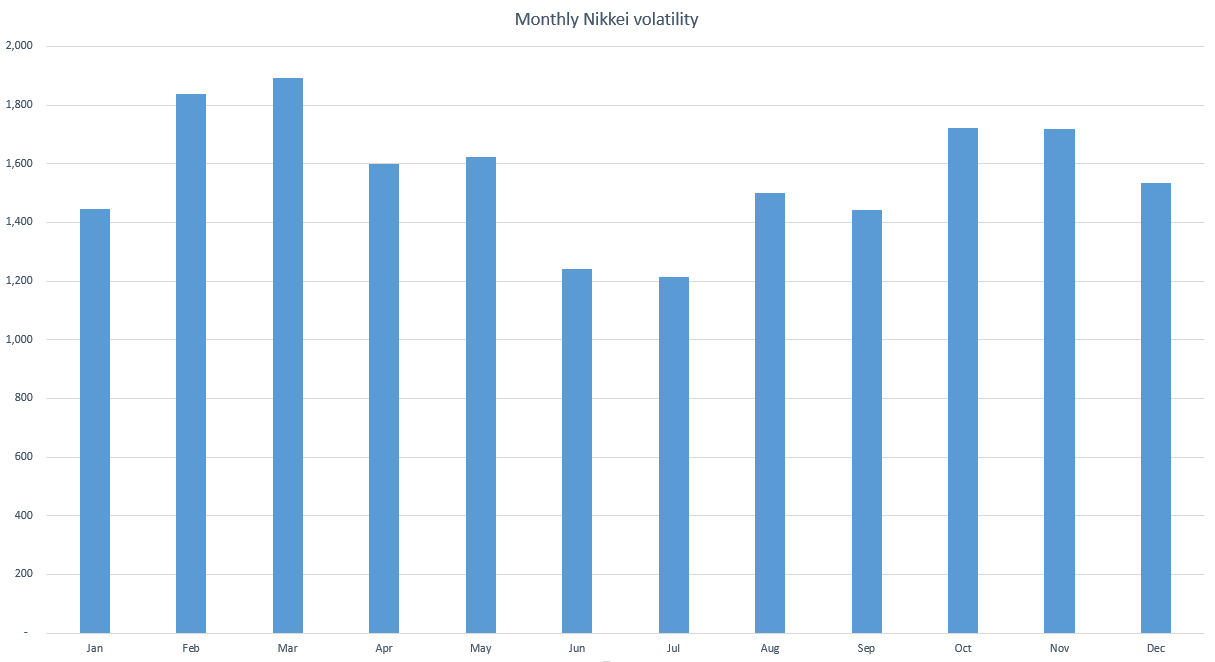

Monthly Nikkei 225 volatility from 2011 to 2021

August is the 8th most active month of the year. There is a high chance of a busy August for the Nikkei this year as there are a lot of potential news releases that could impact the market.

Ranking of monthly Nikkei 225 volatility from 2011 to 2021

1st Mar 1,891 yen

2nd Feb 1,839 yen

3rd Oct 1,723 yen

4th Nov 1,718 yen

5th May 1,622 yen

6th Apr 1,599 yen

7th Dec 1,534 yen

8th Aug 1,501 yen

9th Jan 1,446 yen

10th Sep 1,441 yen

11th Jun 1,241 yen

12th Jul 1,214 yen

Market factors

Intervention by the Bank of Japan

The Yen is historically weak hitting 22-year highs at 139.40 recently which is causing concern within the Japanese government and Bank of Japan. Whilst the weak yen helps Japanese exporters make more profits, the weak Yen is pushing up the price of goods for Japanese consumers and hurting Japanese consumer confidence. Increasingly Japanese Government officials are publicly stating the yen is too weak against the USD which is increasing the probability of the Bank of Japan entering the market to stop the Yen`s weakness.

Any action from the Bank of Japan will have a major impact on the Yen and the Nikkei and result in a large increase in volatility and profitable trading opportunities. While unlikely there is a chance the Bank of Japan could enter the market to buy the Yen in August. Should the Bank of Japan enter the market it will be as aggressive as possible to have the biggest impact. A large fall in the USDJPY would likely result in a large short drop in the Nikkei.

US equities

The biggest factor in movements in the Nikkei 225 index is US equities. Due to high inflation in the US the Fed has been raising interest rates aggressively resulting in large falls in the first half of 2022.

August will see further interest rate rises and volatility will remain higher than historical levels. In the past couple of weeks, the market has hit support $30,000 and now trading sideways. It is not likely this range trading condition will continue and large moves are possible in August.

The long-term US equities up trend is strong so if there are lower than expected inflation figures in the US we could see a quick rise in August. Should the US inflation continue to increase and economic growth weakens a break of $30,000 could see panic selling over August.

US interest rates

Rising US interest rates are having a major impact on the Nikkei. As US interest rates rise the USD/JPY strengthens with a positive for many companies in the Nikkei index due to higher profits on exports. On the other hand, rising US interest rates are negative for US equities which can harm the Nikkei 225 index.

The market is expecting further interest rates in August but the size of the interest increase is not decided yet. In August there will be many economic data releases on US inflation and economic growth which could quickly change market expectations. August 2022 is likely to be a volatile month and present many good trading opportunities.

Bitcoin

Movements in the price of Bitcoin are increasingly having an impact on the market's risk sentiment. Bitcoin has fallen significantly resulting in many beginner investors losing a lot of money and resulting in them selling their equity positions.

Recently Bitcoin has held important support at $20,000 and starting to rise again. Should Bitcoin become popular again and rise significantly above $30,000 this could have a positive impact on the Nikkei. Watching and understanding movements in Bitcoin is important for all traders.

Popular technical strategies

Nikkei 225 daily chart May to July 2022

The most popular trading strategies in the Nikkei at the moment are range trading strategies. Japanese traders like to use moving averages, RSI and MACD indicators when looking for trading opportunities. Also, it is important to understand that many Japanese avoid using stop loss orders and prefer to add to their losing positions. When the market breaks important support or resistance many Japanese traders will be sitting on large losses which could result in panic and large moves.

Trading strategies for the Nikkei 225

The Nikkei has not suffered the same losses as US equities so there is a lot of potential upside for the Nikkei. At the moment the market is in a range between 28250 and 26250 so range trading is the most effective trading strategy. Should the market break resistance at 28250 the market could quickly move up to 30000.

When the market is in a range a successful strategy can be to wait for the market to move away from the moving average and then trade against the market. A popular indicator when trading the Nikkei 225 is a 10 day moving average as it presents regular trading opportunities. Recently when the market moves more than 500 yen above or below the 10 day moving average it is profitable to range trade.

Due to the Nikkei being in a range for the past couple of months there is a potential for the market to make a large move when the range breaks. Many traders get lazy and assume the market will stay in a range for a long time. Should the market rise above 28250 or fall below 26250 there is a potential for a large move so it is important to be flexible and quickly change from a range trading strategy to a trend trading strategy when required.

Currently, the market is closer to resistance and there has already been a lot of bad news in world equity markets in 2022. Should inflation worries reduce and positive economic news from the US there is a potential for the market to resume the strong uptrend from 2021.